Intelligent Underwriting

Portal

Role: UX/UI Designer

Duration: 2 years

Team: Collaborated with a senior designer

My Contribution: I worked upon this ambitious underwriting project from start to end and owned most parts of it. I did collaborated with senior designer to get timely feedback on my designs and the design direction.

Context

“Underwriting is to evaluate insurance applications and analyse the risk involved to establish the pricing of the insurance premium.”

For more than 30 years, Accenture has been helping world’s leading insurance companies to plan and implement complex business and operational changes. While it has worked upon on different insurance use cases, Accenture figured that underwriting is more expensive than it needs to be and less efficient than it should be. With time underwriting environment is becoming more complex, yet it is expected to work faster, more accurate quotes.

Product Vision

Through initial meetings with Product manager and stakeholders we understood the need for developing the MVP for an insurance product. We started by thoroughly reviewing the briefing and started gathering insights. This gave us an initial understanding of the project's objectives and goals.

One-stop-shop to view, analyse and process submissions.

A seamless experience for both underwriters and UW manager to smoothly collaborate and close submissions. Through self-service options, intuitive interfaces, and quick response times, the portal can simplify the application process, reduce paperwork, and provide real-time status updates.

Improve quality and support effective underwriting decisions.

The intelligent underwriting portal can generate valuable insights and analytics from the collected data. By leveraging this information, insurers can gain a deeper understanding of their underwriting process, identify trends, assess risk patterns, and make data-driven decisions for continuous improvement and better risk management.

Automation to speed up underwriting processes.

Automated alerts to improve the underwriting workflow by streamlining reviews, escalations and task completion. It automatically ingests submissions, extracting and cleansing data, then supplementing it with third-party data.

My Approach

Discovery

-

Project Initiation and Briefing to understand project vision.

-

In-depth session with data science experts to gain domain specific knowledge.

-

Fit & Gap Analysis done on legacy products to identify opportunities.

Define

-

Prioritised and scoped identified screens & functionalities on Miro Planning Board.

-

Integration with backend modules.

-

Created user personas.

-

Defined user task flows.

Design

-

Ideations & wireframes.

-

Designed hi-fidelity screens and prototypes using Figma.

-

Customise components and added to brand’s guidelines and internal design system.

-

Iterate. Iterate. Iterate

Deliver

-

Collaborated with Dev team using JIRA throughout product development (5 Iteration, 30 sprints)

-

Tailored Client Demos & Feedback

-

Finalisation & Deployment

Scaling & Expanding

We started out with a team of 8 members, but eventually grew to team of 40 members in a span of 1.6 years, UX designers remaining the same ( i.e. Senior mentor and me). The portal continues to iterate and enhance it’s capabilities to help major insurance companies transform their process.

Early Insights from Experts

To gain a deep understanding of the insurance domain, we attended an insurance overview session led by a data science expert. This session provided us with valuable domain knowledge and insights into the challenges faced by insurance professionals.

#1 Lack of Automation

Manual review takes time. Almost 40% of underwriters task goes transferring data into system and reviewing them manually. This negatively impact their workload. Not to bring redundant and missing data.

#2 Difficult to Analyse

Underwriters have an abundance of data, but it’s not at their fingertips or in a usable format to support sound decision making. We need to help underwriters do what they’re best at analysing information, uncovering patterns and making decisions based on a holistic view of an applicant.

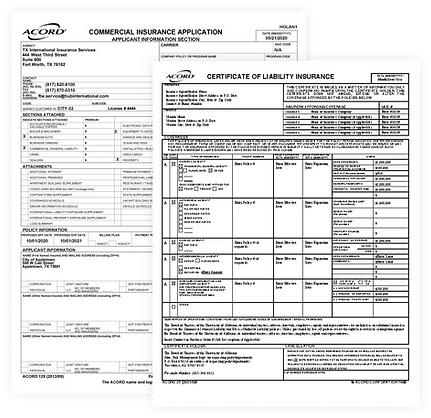

#3 Scattered Information

Underwriter’s job is to review data across different sources and synthesise it to make an accurate (and profitable) decision. Since there's no unified solution exists, underwriters still have to move between different documents, looking for data that’s formatted in different ways depending on how it’s coming from.

Fit & Gap Analysis with Existing Product

We conducted a fit and gap analysis by comparing the project requirements with an existing product at Accenture. This analysis allowed us to identify areas where the existing product fell short of meeting the project's specific needs. We categorised these gaps as potential problems to address and where customisation or new features were needed for the MVP. Note: This isn't original representation of our Analysis. This is just an mock table with omitted information to comply with non-disclosure agreement with company.

Connecting all the dots...

While my primary focus was on the user-facing underwriting interface, it's essential to note that this project was part of a broader ecosystem. The underwriting interface seamlessly integrated with multiple backend modules, including data extraction, data ingestion, machine learning models etc. Working within this collaborative ecosystem, I had to ensure that the user interface I designed not only met user needs but also aligned with the functionalities of the backend systems. This required close coordination with the development teams responsible for these modules. We aimed to create an underwriting interface that simplified the user's interaction with these advanced technologies, providing a seamless and efficient experience.

User Persona

Based on the finding, I created Underwriters persona to mark and address their needs, wants and limitations.

Mark Riley

Mark is an underwriter for a large insurance company where he analysis information and determine risk involve in insuring businesses. His primary focus is on two Line of business: Inland marine & General Liability

Goals:

-

To carefully assess and approve submissions in timely manner.

-

To balance risky and safe submissions to maximise organisation's profit.

-

To identify and be caution about fraudulent submissions.

Needs:

-

Simple way to view collected data from multiple sources in one place.

-

Ability to make confident decision at each stage of underwriting.

-

Faster decision making and resolution as a result of automation and smart recommendation

Pain Points:

-

Scattered Information like 3rd party across multiple platforms.

-

Incomplete information leading to delays in submission processing.

-

Challenges in analysing varied different format information.

User Flow

Despite the complexity of the backend infrastructure, our approach remained firmly user-centric. I aimed to create an user flow that simplified the user's interaction with these advanced technologies, providing a seamless and efficient experience. I started off with the below basic structure. As we dived deep, we made lot of changes to this. We got lot of edge cases. We got lot of additional information during the process and we got lot of feedback as well on the process flow. So this was something we had to start of with but it changed overtime.

Awards & Achievements

Not only I’ve been part of this project from start to finish I’ve also bagged 🏆 APP Pinnacle Award FY23 - Q1 for my contribution in it. Based on my dedication and zeal to learn, I've also received multiple recognition.